Instance of ways to use the potential worth formula manually

Towards offer an easy instance, let's state an item of realty you've been actually wanting to offer has actually captured the rate of passion of a purchaser. The prospective purchaser provides you $20,000 towards acquisition it today however likewise provides towards pay out you $500 much a lot extra if they can easily purchase the exact very same residential or commercial home in 2 years.

Although a greater resettlement noises much a lot better, based upon the moment worth of cash concept, $20,000 today deserves greater than $20,five hundred in 2 years.

You choose towards stay with this concept as well as create today's cash help you. You get the $20,000 the realty purchaser provided you today as well as down payment the round figure right in to a cost financial savings profile along with a 2% substance rate of interest every year.

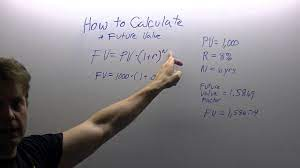

Towards determine just the amount of cash your financial assets can easily create you, connect in the appropriate variables as well as utilize the potential worth formula.

FV = twenty,000 x [ 1 + (.02 / 1) ] (1 x 2)

FV = twenty,808

Through this reasoning, the $20,000 the realty purchaser pays you today will certainly deserve $20,808 in 2 years if you spend it inning accordance with strategy.

Nevertheless, if you get the two-year deal of $20,five hundred, you'll lose on $308 of rate of passion coming from your cost financial savings profile. Once once more, even if the potential deal seems like much a lot extra doesn't imply it will certainly wind up being actually much a lot extra.

Associated: There is a Brand-brand new Method towards Faucet Your Home's Equity Without Lendings or even Regular month-to-month Resettlements

Instance of ways to use the potential worth formula through an information cpu

If by-hand computations may not be one thing you anticipate, you can easily likewise discover potential worths utilizing devices such as Microsoft Stand out as well as Google.com Sheets.

carefully associated element you may encountered as you determine the moment worth of cash as well as exactly just how it relates to financial assets chances is actually the web existing worth. When you choose towards spend, the really wish is actually that you'll get an ROI.

Additionally, a strong ROI certainly not just surpasses the quantity of your financial assets however can easily likewise offset any type of prospective losses because of the TVM.

The web existing worth is actually a formula that predicts potential financial assets development towards today's bucks. Web existing worth represent the moment worth of cash as well as the decreasing worth of potential cash so as to reveal the supreme worth of your financial assets.

Komentar

Posting Komentar